All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Roth 401(k) contributions are made with after-tax contributions and then can be accessed (profits and all) tax-free in retired life. 401(k) plans are designed to help workers and company proprietors develop retirement cost savings with tax obligation advantages plus receive possible employer matching payments (complimentary added cash).

IUL or term life insurance policy might be a need if you want to pass cash to heirs and do not think your retired life financial savings will meet the objectives you have actually specified. This material is intended only as general information for your benefit and ought to not in any type of means be taken as financial investment or tax advice by ShareBuilder 401k.

Nationwide Iul Accumulator Review

If you're looking for life time protection, indexed universal life insurance is one option you may want to think about. Like various other long-term life insurance coverage products, these plans allow you to develop money worth you can tap throughout your life time.

That implies you have extra lasting growth possibility than an entire life policy, which offers a fixed price of return. However you also experience a lot more volatility given that your returns aren't ensured. Typically, IUL plans avoid you from experiencing losses in years when the index loses worth. They likewise cover your rate of interest credit history when the index goes up.

As long as you pay the premiums, the policy continues to be in pressure for your whole life. You can collect money worth you can utilize throughout your life time for various economic needs.

Long-term life insurance policy plans frequently have higher initial costs than term insurance coverage, so it might not be the right choice if you're on a tight budget plan. The cap on rate of interest credit histories can limit the upside potential in years when the securities market performs well. Your policy might gap if you get also large of a withdrawal or plan loan.

With the potential for more durable returns and adjustable settlements, indexed global life insurance policy might be an alternative you intend to consider. However, if taken care of annual returns and locked-in premiums are very important to you, an entire life policy may represent the much better option for irreversible protection. Interested to learn which insurance policy product suits your needs? Get to out to a financial specialist at Colonial Penn, that can review your individual scenario and supply personalized understanding.

Indexed Universal Life Insurance Good Or Bad

The details and summaries included right here are not planned to be total summaries of all terms, conditions and exclusions applicable to the services and products. The precise insurance policy coverage under any nation Investors insurance product is subject to the terms, problems and exemptions in the real policies as released. Products and services defined in this web site vary from one state to another and not all items, insurance coverages or solutions are available in all states.

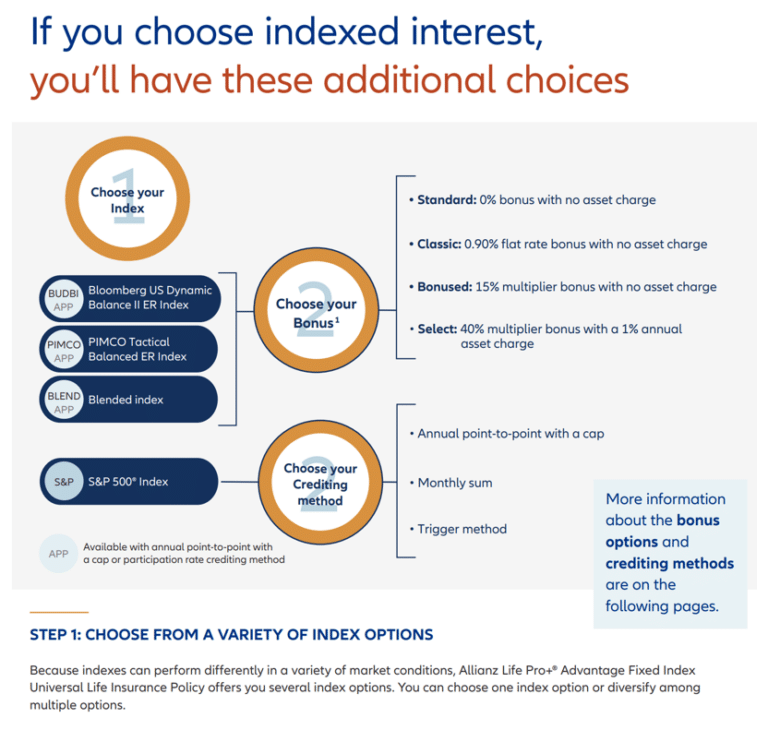

If your IUL plan has ample money worth, you can borrow against it with flexible settlement terms and low interest rates. The choice to design an IUL policy that shows your particular requirements and circumstance. With an indexed global life plan, you allot premium to an Indexed Account, consequently producing a Section and the 12-month Section Term for that segment starts.

At the end of the segment term, each sector earns an Indexed Credit report. An Indexed Credit report is determined for a segment if value stays in the segment at segment maturation.

These restrictions are determined at the beginning of the segment term and are assured for the entire sector term. There are four options of Indexed Accounts (Indexed Account A, B, C, and E) and each has a various type of restriction. Indexed Account A sets a cap on the Indexed Credit report for a segment.

The growth cap will vary and be reset at the start of a section term. The engagement price figures out exactly how much of a boost in the S&P 500's * Index Worth relates to sectors in Indexed Account B. Greater minimal growth cap than Indexed Account A and an Indexed Account Fee.

Chicago Iul

There is an Indexed Account Fee related to the Indexed Account Multiplier. Regardless of which Indexed Account you pick, your cash value is constantly safeguarded from negative market efficiency. Cash is transferred at the very least when per quarter right into an Indexed Account. The day on which that happens is called a sweep date, and this develops a Segment.

At Sector Maturity an Indexed Credit rating is computed from the modification in the S&P 500 *. The value in the Sector gains an Indexed Credit report which is determined from an Index Development Rate. That development rate is a percentage modification in the current index from the beginning of a Sector up until the Segment Maturation day.

Sections immediately restore for one more Segment Term unless a transfer is asked for. Costs obtained because the last sweep day and any type of asked for transfers are rolled into the exact same Sector to make sure that for any kind of month, there will certainly be a single brand-new Segment created for a provided Indexed Account.

Wrl Financial Foundation Iul Reviews

As a matter of fact, you may not have actually assumed a lot about exactly how you desire to invest your retired life years, though you most likely recognize that you don't wish to run out of money and you 'd like to keep your existing lifestyle. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] In the past, individuals relied on three primary income sources in their retirement: a business pension plan, Social Safety and whatever they 'd managed to conserve.

Less companies are using traditional pension. And many firms have minimized or ceased their retirement plans. And your ability to rely solely on Social Protection is in inquiry. Also if benefits haven't been decreased by the time you retire, Social Safety alone was never ever planned to be sufficient to spend for the lifestyle you want and are worthy of.

What Does Iul Stand For

While IUL insurance policy may confirm valuable to some, it's important to comprehend just how it works before purchasing a policy. Indexed global life (IUL) insurance coverage plans provide better upside potential, adaptability, and tax-free gains.

As the index moves up or down, so does the rate of return on the cash money worth component of your plan. The insurance firm that issues the policy might offer a minimal surefire price of return.

Economists usually encourage living insurance coverage that amounts 10 to 15 times your annual earnings. There are numerous downsides related to IUL insurance plan that doubters are fast to point out. Somebody who establishes the policy over a time when the market is carrying out inadequately can end up with high costs payments that don't contribute at all to the cash money value.

Aside from that, bear in mind the complying with various other factors to consider: Insurance provider can establish engagement prices for just how much of the index return you receive every year. Allow's state the policy has a 70% involvement price. If the index grows by 10%, your cash money value return would certainly be only 7% (10% x 70%).

Furthermore, returns on equity indexes are usually topped at an optimum quantity. A plan may claim your optimum return is 10% each year, no matter how well the index executes. These limitations can restrict the actual price of return that's attributed toward your account every year, no matter exactly how well the policy's underlying index carries out.

IUL policies, on the various other hand, deal returns based on an index and have variable premiums over time.

Latest Posts

Best Equity Indexed Universal Life Insurance

Iscte Iul Fenix

Indexed Universal Life Policies